|

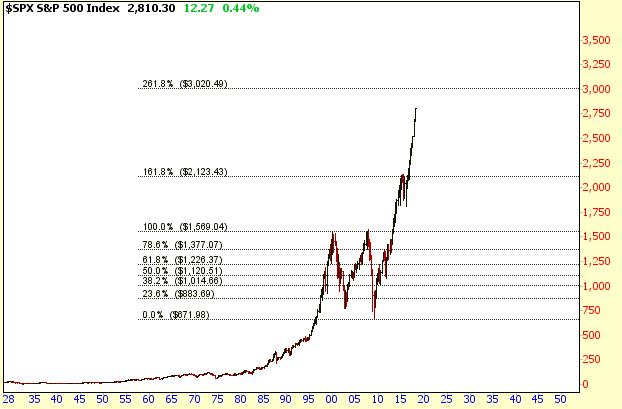

(1/20/18)

The S&P in terms of "Real Dollars" is now tied with 1835 as the 2nd most

overvalued market in its history based on the % distance from its long term

mean. Only the late 1990's was more overvalued than today.

Meanwhile, although the S&P is way above the top of its long term upward channel

(red line), it still hasn't reached the trend line connecting the mid 1830's

peak with the late 1990's peak (purple line).

I calculated the trend line connecting the mid 1830's peak with the late 1990's

peak to be around the 3000 level. If the S&P were to reach this level it

would become the most overbought market ever based on the % distance from its

long term mean (point A).

Furthermore if we take a look at Fib Extension Levels, calculated from the 2007

high to the 2009 low, notice the 261.8% Fib Extension Level is at the 3000 level

as well. Personally I never thought the S&P would ever go this high,

however, the ways things are going it appears those that control the market are

hell bent on getting it up to the 3000 level.

Amateur Investors

|